unified estate tax credit 2021

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special. For 2021 the estate and gift tax exemption stands at 117 million per person.

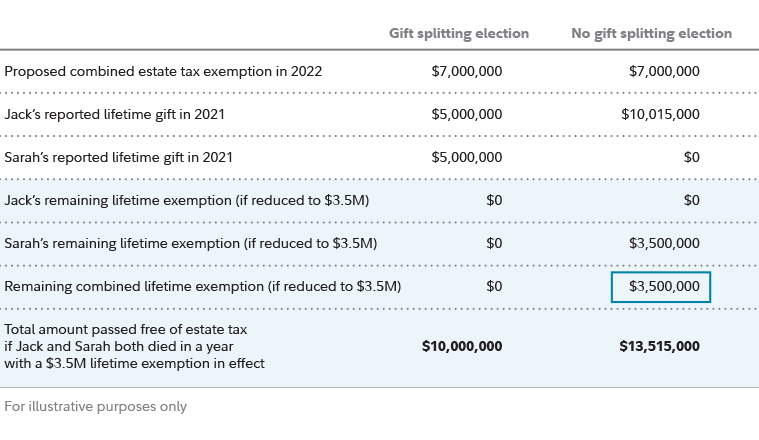

Estate Planning Strategies For Gift Splitting Fidelity

The tax credit can be deposited directly in your bank account.

. However the unified tax credit has a set amount that an individual can gift during his or her lifetime before. The size of the estate tax exemption means very. The tax is then reduced by the available unified credit.

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of 55 to a n. For gifts or estates over the exemption amount Gift and estate. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

As of 2021 the federal estate tax is 40 of the inheritance amount. News November 29 2021. The gift and estate tax.

The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. The previous limit for 2020 was 1158 million. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

The chart below shows the current tax rate and exemption levels for the gift and estate tax. The unified credit is per person but a married couple can combine their exemptions. The exclusion amount in 2021 increased to.

We last updated the Unified Tax Credit for the Elderly in January 2022 so this is the latest version of Form SC-40 fully updated. Gifts and estate transfers that exceed 1206 million are subject to tax. In Revenue Procedure 2021-45 RP-2021-45 irsgov the Internal Revenue Service announced annual inflation-adjusted tax rates for 2022 including.

This means that the federal tax law applies the estate tax to any amount above 1158 million for individuals and 2316 million for married couples. Ad We Put Money in Your Pocket-No Upfront Fee-Property Tax Appeal Experts. This is called the unified credit.

Any tax due is. For 2021 that lifetime exemption amount is 117 million. In other words use it or lose it.

The basic exclusion amount for determining the unified credit against the estate tax will be 11700000 up from 11580000 for decedents dying in calendar year 2021. The federal estate tax exemption for 2021 is 117 million. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. This means that an individual is currently permitted.

The estate tax exemption is adjusted for inflation every year. After the unified credit limit is reached the donor pays up to 40 percent on. Unified Tax Credit for the Elderly Married Claimants Must File Jointly FORM SC-40 State Form 44404 R20 9-21 2021 Due April 18 2022 Taxpayers date of death Spouses date of death 1.

What Is the Unified Tax Credit Amount for 2021. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Exhibit 25 1 Unified Transfer Tax Rates Not Over 10 Itprospt

Unified Tax Credit What Is The Unified Tax Credit And Why You Should Care Waldron Schneider

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

John R Dundon Ii Enrolled Agent Is That Gift Taxable Irs Form 709

2021 Year End Tax Planning Roundup

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

What Is The Unified Tax Credit How Does It Change Federal Gift And Estate Taxes

U S Estate Tax Exposure For Canadian Residents Who Are Not U S Citizens Manulife Investment Management

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/WhatIsaUnifiedTaxCreditAug.92021-f598bf82c87b42a7b139f10953ad3850.jpg)